Writing A Letter Of Explanation For Derogatory Credit

Guide to writing a mortgage letter of explanation (with template)

Craig Berry

The Mortgage Reports

Contributor

July 20, 2021

-

4 min read

Your lender asked for a letter of explanation. What now?

When you apply for a home loan, your lender will do a deep dive into your financial history. Depending on what it finds in your bank statements or credit report, additional documentation may be necessary.

You may be asked for a "letter of explanation" during the application process. Fear not. Letters of explanation are fairly standard and nothing to worry about.

However, you want to make sure you write this letter correctly, as it could be crucial to your mortgage approval.

Here's everything you need to know so you can hit a home run with your letter of explanation.

Start your mortgage application today (Nov 9th, 2021)In this article (Skip to...)

- What is a letter of explanation?

- How to write one

- Sample letter

- Final advice

What is a mortgage letter of explanation?

Commonly referred to as an 'LOE' or 'LOX,' letters of explanation are often requested by lenders to gain more specific information on a mortgage borrower and their situation.

An LOX can necessary when there is inconsistent, incomplete, or unclear information on a loan application.

Letters of explanation may be required if any red flags turn up during the underwriting process, such as:

- Declining income

- Gaps in your employment history

- Differing names on your credit report

- Large deposits or withdrawals in your bank account

- Recent credit inquiries

- An address discrepancy on your credit report

- Derogatory items in your credit history

- Late payments on credit cards or other debts

- Overdraft fees on an account

There are many other situations where an LOX may be requested, too.

If you need to write one, be sure to ask your loan officer what exactly the underwriter wants to see, and whether you need to provide any supporting documentation along with the letter.

How to write a letter of explanation for your mortgage lender

When it comes to mortgage letters of explanation, less is typically more.

Too much unnecessary information may lead to confusion, or at minimum, additional questions about your file – questions that may have been avoided if it weren't for some of the details in your letter.

The most important elements of your letter of explanation should include the following:

- Facts – Be honest. Never be tempted to write a letter based on solely on what you may think your lender wants to hear. You shouldn't fabricate any aspect of your letter. Include correct dates, dollar amounts, and any other pertinent details for your situation

- Resolution – Your lender wants to know how and when the situation that led up to certain events was resolved. For instance, if you were temporarily furloughed during COVID, but you've since returned to full employment, you should be able to document your recent paystubs and have your employer verify that you'll continue working full time for the foreseeable future

- Acknowledgement – This one is important and shouldn't be left out of your letter. Mortgage underwriters want to know why it is that something happened, and how or why it won't happen again in the future

Remember that a letter of explanation is a professional document that will go into your loan file.

Be mindful of things like spelling, grammar, and punctuation. Create a letter that's visually appealing, properly formatted, and communicates the relevant information.

Providing additional documentation with your letter can be helpful. For example, if hospitalization was the culprit behind some missed payments on your credit report, it may be helpful to include hospital bills.

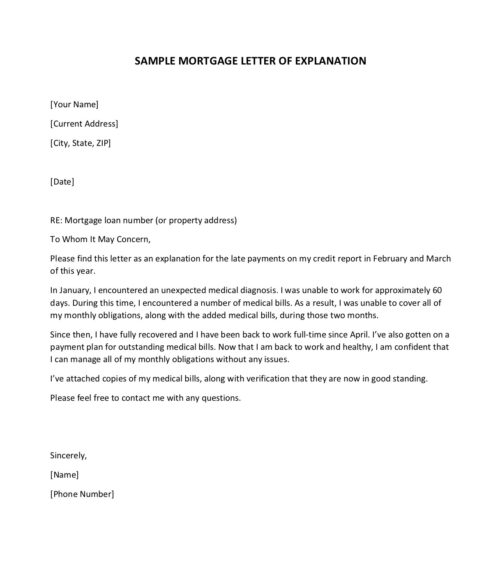

Sample letter of explanation and template

Remember to be honest, formal, and concise when writing a letter of explanation for your mortgage lender.

The exact content will vary based on your situation, but here's a general letter template you can use as a guide. (Click the image to open a PDF version.)

Remember to include your mailing address, phone number, and the number of your mortgage loan application (or the property address for which you're applying).

Final advice on writing a letter of explanation

You'll be asked to submit a pile of documentation during the mortgage loan process, including bank statements, tax returns, pay stubs, and more.

Depending on your financial situation, your lender may also request a letter of explanation. Many first–time home buyers think being asked to provide a letter of explanation means their mortgage application may be doomed.

Remember, this type of request is usually a good thing. The underwriter may be looking for this last item before signing off on your final approval.

When your lender requests a mortgage letter of explanation, remember this first: don't panic.

Next, double–check with your lender on exactly what is being requested.

Then write a clear, concise letter that's free of emotional language, negativity, or excessive detail. There's a good chance that the next time you hear from your lender, it will be to let you know you're fully approved.

Show me today's rates (Nov 9th, 2021)Popular Articles

- Your Guide To 2015 U.S. Homeowner Tax Deductions & Tax Credits October 8, 2015 - 4 min read

- Minimum FHA Credit Score Requirement Falls 60 Points October 11, 2018 - 3 min read

- Fannie Mae HomePath mortgage: low down payment, no appraisal needed, and no PMI January 23, 2016 - 4 min read

- Fannie Mae's mandatory waiting period after bankruptcy, short sale, & pre-foreclosure is just 2 years December 11, 2018 - 4 min read

- Gift letter for mortgage: How to give or receive a down payment gift April 8, 2021 - 7 min read

- FHA Lowers Its Mortgage Insurance Premiums (MIP) For All New Loans January 26, 2015 - 5 min read

- Shop for mortgage rates without lowering your credit score November 19, 2018 - 6 min read

- Conventional Loan 3% Down Available Via Fannie Mae & Freddie Mac April 8, 2015 - 7 min read

- Low-down-payment mortgage options: 3% down mortgages for first-time home buyers March 11, 2021 - 10 min read

- Do bi-weekly mortgage programs pay your mortgage down faster? September 18, 2018 - 4 min read

- LTV explained: What is "loan to value" for a mortgage? July 10, 2020 - 8 min read

- 2021 VA Loan Residual Income Guidelines For All 50 States And The District Of Columbia January 2, 2020 - 4 min read

- 8 Ways To Get A Mortgage Approved (And Not Mess It Up) May 26, 2016 - 3 min read

- 4 ways to keep your mortgage closing costs low June 22, 2017 - 4 min read

- USDA eligibility and income limits: 2021 USDA mortgage June 18, 2021 - 4 min read

- What are mortgage discount points and how do they work? December 31, 2020 - 7 min read

- You Don't Need A 20% Downpayment To Buy A Home February 20, 2019 - 5 min read

- First Time Home Buyer : The Early-2017 Guide to Buying a Home March 10, 2017 - 8 min read

- Don't Have 20% To Put Down? No Problem With These 5 Popular Mortgage Programs. March 5, 2014 - 4 min read

- USDA Home Loans : 100% Financing And Very Low Mortgage Rates April 18, 2017 - 4 min read

- Buying A Home With A Boyfriend, Girlfriend, Partner, Or Friend July 17, 2016 - 3 min read

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Writing A Letter Of Explanation For Derogatory Credit

Source: https://themortgagereports.com/75907/mortgage-letter-of-explanation-template

Posted by: cornettinglacrievor.blogspot.com

0 Response to "Writing A Letter Of Explanation For Derogatory Credit"

Post a Comment